Trading options has many advantages when investing if done correctly. Options can help mitigate risk when placing trades and can also be a source of profit. We will go over Calls, Puts, Covered calls, and Cash-secured Puts.

The textbook definition of an option is - A tool that gives the owner the right THE RIGHT to buy/sell 100 shares of a stock at a fixed price by an agreed upon date. This is also known as an options contract because you do not own the shares; you just have the right to buy or sell them. This will be explained more as we go along. You can exercise your contract at any point until the agreed upon end date.

Call Options

Screenshot taken from Schwab's website of Apple's call options

I know this looks confusing, but when we break it down into its parts, it is not that bad.

Strike price- price you buy the option for (195 in this call option example)

Let's say you think Apple will go up in the next 60 days. So instead of buying 100 shares of the stock for $18,990 (Price at the day of writing) you buy a call option for the OPTION to buy 100 shares of apple at the strike price. So, if we set our strike price at 195 and buy the contract for the ASK price for $22 (Price of the contract is known as the Premium)(.22 is ask price but since it is 100 shares you multiple the ask price by 100). This gives you the option to buy 100 shares of Apple at 195 no matter what the stock price is. So, you paid $22 for the option to buy 100 shares of Apple at any price within the agreed upon date.

Scenario 1

Apple stock goes up to 210 in the 60 days and since you bought the contract you can buy them from whoever sold the contract to you at the strike price of 195. This means you buy the shares for 195 then sell them back to the market (or can keep them) at the 210 price and pocket the difference. So, it cost $22 for the contract, and you made $15 a share x 100 shares for a profit of $1,478.

Scenario 2

You buy a call option with a strike price of 195 for $22 and the stock goes to $192 from the current $189.90. Now, even though the stock went up, your contract is worthless because you bought the option to buy shares at $195. Why would you buy shares at $195 when the market price is $192? This means you lose your $22 and the contract is worthless and disappears.

Scenario 3

You buy a call option with a strike price of $195 for $22 and the stock tanks to $180 from the current $189.90. This renders your contract useless, and it disappears because, again, why would you buy the stock at the $195 strike price when the market price is $180?

When buying call options, remember you want the stock to go not only above the strike price but also high enough to make a profit because you paid money for the contract. This strategy is good because it can limit how much risk you are exposed to. If you had bought 100 shares at $189.90 for $18,990 and the stock went to $180, you would lose $990. But with the call option, you only lost $22. On the flip side, your gains can be limited as well. For example, $189.90 to $210 a share would mean a profit of $2,010 for 100 shares, whereas your profit in Scenario 1 was $1,478.

The price to buy the contract is based on a few factors such as time and volatility of the stock. The longer the contract, the higher the price because you have more time for the stock to go above your strike price. The same applies to volatility. Apple is not a very volatile stock, so the chances of big swings in a few months are lower, meaning the contract is less expensive. Whereas a volatile stock has a higher chance of going above the strike price, so the option is more expensive.

Put Options

Think of Put options as the exact opposite of call options. We will use Cisco for this example. Cisco is currently trading at $48.17 but we will use $48 for easier math.

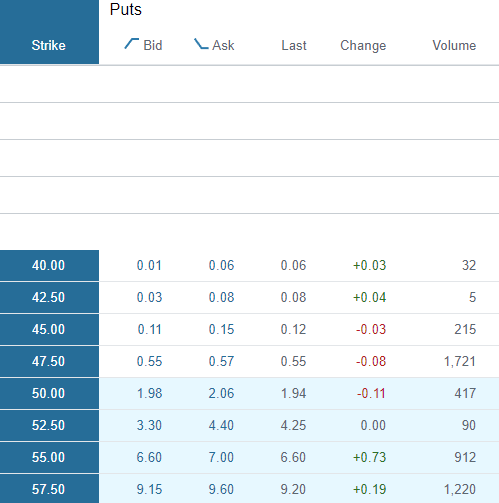

Page is priced for 33 days out

When we buy the put option, we are giving the seller the option to buy Cisco's stock from us at the strike price of $45. So, we now have the option to sell Cisco to the other person for $45 a share. But this option is not free, and we have to pay $15 for the option to do this.

Since Cisco is trading at $48, we would not buy it at $48 then sell it for $45 because we would lose $3 a share. This means you want Cisco's stock to CRASH in the next 33 days.

Scenario 1

If the stock crashes to $35, this means you can buy it on the market for $35 then exercise your contract and sell it for $45. This means you made $10 a share (Bought at market $35, then sold for contract strike price of $45 for a gain of $1000). But you paid $15 for this option, bringing your profit to $985.

Scenario 2

Cisco's stock does not go below the $45 strike price and stays at $48. This means you would not exercise the contract because why sell it for $45 when you can sell it on the market for $48. This means you just lose the $15 you paid for the contract.

You do not literally have to go to the market and buy the 100 shares then exercise the put option. Normally, your brokerage firm does this for you. But if you go into your brokerage account and then to your options you can put sell to close as the action to close the contract for the gains at any point within the agreed upon date.

Options Strategies

Covered Calls

This strategy can be used to mitigate risk and/or serve as passive income weekly, monthly, or annually. Unlike earlier when we were buying call options, now we are selling call options AND buying the stock.

Ex. For this we example, we will use real numbers and the company Intel.

This is Intel's (INTC) call list as of the day I am writing this and the stock is at $31.87, but we will use $32 for easy math.

Covered calls involve buying 100 shares of the stock and selling a call option. For this example, we will use 62 days out (about 2 months). So, we bought 100 shares of Intel at $32 for $3200 and we are selling a call option because someone wants the option to buy Intel at $34 strike price. The option to do that comes with a price of $94 (I pocket this).

As of now I have 100 shares for 3200 and made $94 by selling a call option to someone who thinks Intel's stock price will go above his $34 stock price.

Scenario 1

Intel's stock goes down to $30 in the 62 days. This means we lost $2 per stock for a loss of $200 but since we sold the contract that was rendered useless because the price went down, and we pocketed $94, we are only down $106.

Scenario 2

Intel's stock stays the same meaning you made no money for holding the stock BUT you made $94 for selling the call option which was useless because the stock did not go above the strike price.

Scenario 3

Intel goes up a little from $32 to $33 and this is a great scenario for you as you make money from your stock going up to $33 and the contract was useless because the price is below the strike price. So, you made $100 from the stock and $94 from selling the call option.

Scenario 4

The price of intel goes to moon up to $45 dollars. This means the person who bought your contract will exercise their right to buy Intel shares at the strike price of $34 from you and then sell them on the open market for $45.

BOOM you made money from the stock going up because you bought it at $32 and sold your shares for $34 to the person who bought your contract. You also made money from selling the call option for $94. For a total profit of $200 + $94 = $294.

Now if you had never sold the call option you would have made $13 a share for a profit of $1,300. This strategy is used to mitigate risk and make almost certain gains, but the downside is that your gains are also limited.

Cash-secured Puts

Say a stock is trading at $20 but you can create a situation to buy it a $19. Essentially buying at a discount, and if you do not buy it, you get paid. This is a strategy to get some extra cash and maybe a discount on a stock you plan on purchasing.

Ex. Company - Rocket Lab

Rocket Lab is currently trading at $4.26, so you decide to sell a put option for 1 month saying you will buy RL at $4.00 or below for $10.

Scenario 1

RL stays above $4.00, meaning the contract is not exercised and you pocket the $10 and do not buy any stock. The risk is having to buy RL at $4.00 or below but the reward was $10.

Scenario 2

RL falls to $3.90 which means you have to buy it at $4.00 and are down 10 cents a share. This means you are down $10 from having to buy the stock, but you made $10 for selling the contract so you break even. BUT you liked the stock at $4.26 (hence why you sold the Put) but you ended up getting it for $4 which is a discount because you would have bought at $4.26.

Scenario 3

RL stock crashes to $1 and you will be forced to buy at $4.00 and even though you were paid $10, the stock fell so far that your buy price loses you more than you made when you sold the contract.

Putting this into perspective you would have bought RL at $4.26 but by selling a put option if the stock goes down you pocket the premium and buy the stock at a lower price. But since you were already going to buy the stock, this is no big deal, and you actually get it at a better deal on the stock and extra cash from selling the option. Even if the stock goes below your strike price, you liked and would have bought at $4.26 so exercising the contract and buying at $4.00 was not a bad decision at the time.