American Water Works (AWK)

Ticker - AWK Market Cap - 25B Current Price - 128.25

Business Description:

American Water Works Company, Inc. provides water through its subsidiaries, and wastewater services, in the United States. It offers water and wastewater services to approximately 1,700 communities in 14 states serving approximately 3.5 million active customers. The company serves residential customers and commercial customers. This means pretty much anywhere you can think of, AWK is providing them water. Military bases, schools, hospitals, homes, all of it.

I recommend this stock as a dividend stock, and as I am sure you read in my investing tabs about how to invest in dividend stocks, you not only look at the yield, but also growth compared to inflation, and stock growth. This company has all the parts to be a good long-term hold in your portfolio.

Opportunity

Many climate scientists expect droughts to become more common in the coming years. This is supported by numerous articles, and I will highlight one from the United Nations. "The frequency and duration of droughts will continue to increase due to human-caused climate change, with water scarcity already affecting billions of people across the world," and it goes on to say rising temperatures, deforestation, and over farming are causing more droughts than ever and the water scarcity will only increase. Read the rest of the article here.

This means more extreme weather, or lack thereof, are likely to make the price of water go up. Some believe that mass desalination, or the removal of salt from ocean water, will be necessary to ensure an adequate global water supply.

Now the stock is down about 11% over the last year but this, if anything, can be seen as an opportunity to buy. The company is replacing and upgrading infrastructure that is decades old across its systems, and additionally, the company is growing by acquiring small, typically municipal-owned water systems. While some of its peers have had difficulty closing city water acquisitions, American Water continues to execute on identifying and closing acquisitions (about 500 million this year to be exact).

One thing that is important for water companies is PFAS, which is essentially how many little pieces of plastic are in your drinking water. Companies have to abide by the water act and a bunch of different laws and acts to ensure clean water. They "Recently passed PFAS rules support management's $1 billion investment estimate, with the final rule allowing for a longer five-year compliance period." (Morningstar) This means management continues to work toward greater protection from PFAS liability and is putting money where their mouth is.

How does the Company make money

American Water provides water supply and wastewater treatment services to residential, commercial, and industrial customers. They charge fees for delivering clean water and treating wastewater. These services are essential for communities, and the revenue comes from customer bills like your water bill. Which means they have steady flows of income, as people will always need water and even in tough financial times, such as right now, I have not heard anyone say they are cutting down on water usage to help on their bills.

Management

Susan Hardwick took over as CEO in 2022 and she has been a good steward for shareholders. She previously served as executive vice president and chief financial officer and has extensive prior utility experience.

John Griffith became executive vice president and chief financial officer in 2022, taking over from Hardwick. Griffith has significant investment banking experience in both regulated utilities and renewable energy and could be a very strong hire.

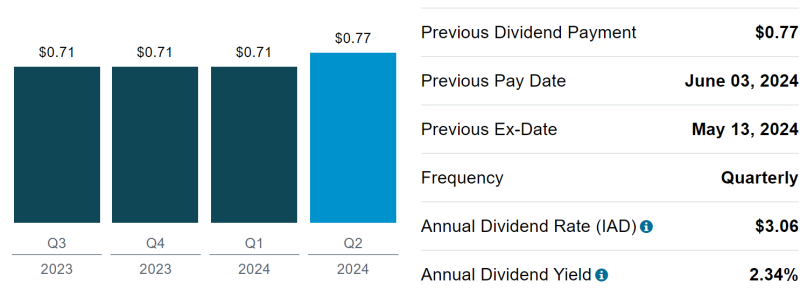

As you can see, they pay a yearly dividend of $3.06, and that number has only grown throughout the years. They have maintained a 9.5% dividend growth rate over the last 10 years, which is incredible. Even during COVID they raised their dividend 10% and this further shows the stability of this company.

Metrics

Revenue - Has been increasing at an average 11% in the past 2 years and excluding covid years has grown about 5% on average. But the 11% growth is very high for a mature utility company, as these usually have more stable, long-term growth.

Operating margin - 35% and this is increasing about 5% every year which is good to see.

Earnings Per Share - 4.96 and has grown from 2.60 in the last 10 years which is good growth.

Return on Equity - 9.81% which is in line with competitors.

Return on Assets - 3.32% which, again, is in line with competitors.

ROIC - 3.45 which is in line, and this is a very important metric cause this company is spending a lot of money to revamp its whole infrastructure in the next few years so making sure returns stay in line is something to watch.

5-year sales growth is about 4.2% which is in line with competitors and not bad at all for a mature company.

They have good margins with a high net profit margin of 22 which beats most competitors and operating, and gross profit margin are in line with their competitors.

Current ratio is less than 1 so they have more debt than assets which is something to look at but they have the income to cover it, which is shown with the dividend increase. Sometimes bigger companies have to take on a lot of debt to help with getting stuck in economies of scale.

Trading

According to Market Beat there was about $500,837.12 in shares bought over the last 12 months to the $100,814.37 sold. The large number of stocks bought compared to stock sold indicates that the insiders in the company believe there is a potential good upside. In some cases, larger purchases can be explained by due date for stock options.

Refinitiv maintains a stock price target of about $146 from the current $127.55

Morningstar maintains a price target of $135 - $142

Argus Analysis report recommends a buy on Schwab's website

Final Thoughts

American Water Works is a more mature Utility company, and this can mean slow, stable, long-term growth. Their immense size plays an advantage to take overs and beating out competitors, and as this is a government run industry, getting in can be very difficult. Droughts are becoming more common, and the amount of water needed on earth will only increase. This company started in 1886 and there is not an end in sight, meaning as a long-term dividend stock this is a great pick. With all the price targets averaging out to about a 10% upside, coupled with the nice dividend and dividend growth, this could be a good company to diversify your portfolio into the utilities sector.

Click the video ⬇️

Add comment

Comments